Sun Pharmaceutical Industries Ltd., commonly known as Sun Pharma, is one of India’s largest and most influential pharmaceutical companies. Over the years, it has established a robust presence both domestically and internationally, particularly in the U.S. market. Investors closely watch its stock, as it reflects not only the company’s performance but also broader trends in the pharmaceutical sector

Current Share Price Snapshot

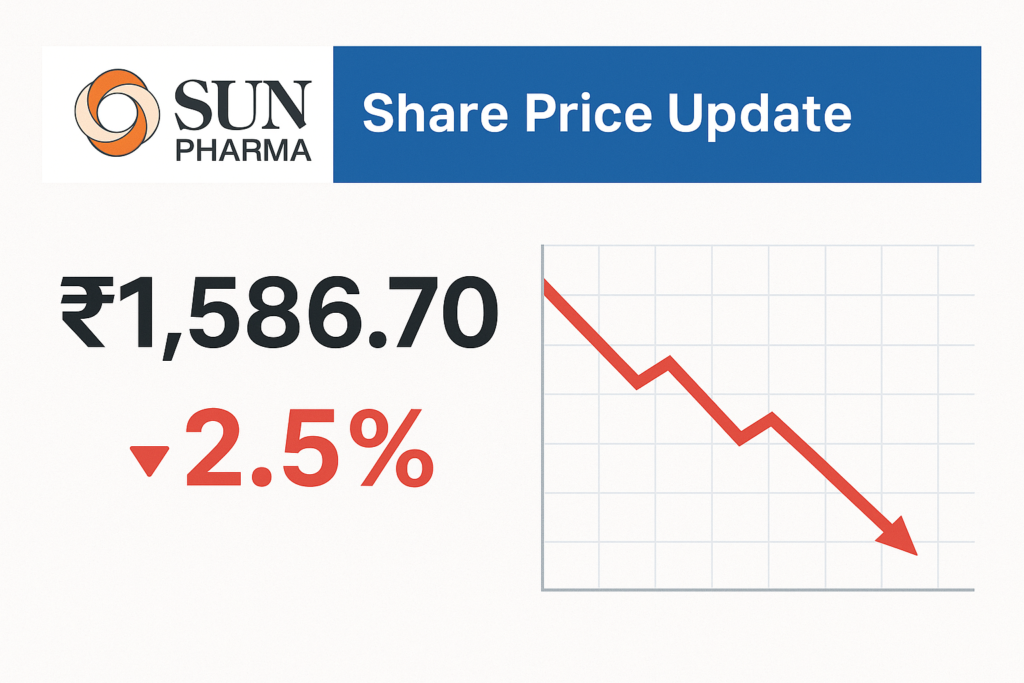

As of September 26, 2025, Sun Pharma’s shares closed at ₹1,586.70, showing a decline of approximately 2.5% from the previous close of ₹1,627.40. During the trading session, the stock touched a 52-week low of ₹1,547.25, raising concerns among investors and market analysts

This sharp dip has been largely attributed to geopolitical and policy-related factors that could impact the company’s revenue streams

Factors Affecting Sun Pharma’s Stock

Recently, U.S. President Donald Trump announced a 100% tariff on imported branded and patented pharmaceuticals, effective October 1, 2025. Sun Pharma, with a significant share of its revenue coming from U.S. patented drugs (approximately 17% of total revenue), is particularly exposed to this policy change.

While the policy primarily targets branded drugs, the immediate market reaction saw Sun Pharma’s stock price decline, reflecting investor uncertainty.

Market Sentiment and Trading Trends

Market sentiment has been cautious, with investors closely watching how the tariff may influence profit margins. Analysts note that despite the dip, the long-term fundamentals of Sun Pharma remain strong due to its diversified portfolio, R&D investments, and global market presence.

DIGI MERCH STORE PRINT ON DEMAND

Expert Analysis

HSBC analysts indicate that while Sun Pharma has substantial exposure to U.S. patented drugs, the overall earnings impact may be limited. The company’s strategy of maintaining a mix of generics, branded drugs, and emerging therapies provides a buffer against policy shocks in one region

Analysts also suggest that this temporary dip could present a buying opportunity for long-term investors, considering Sun Pharma’s historical resilience and growth trajectory.

Investment Perspective

- Strong R&D pipeline: Continuous innovation in specialty drugs.

- Global presence: Revenue diversification across multiple countries.

- Strategic acquisitions: Expansion into new markets and therapeutic areas

SunPharmaNSE/BSE. dailyprompt-2124

SunPharmashareprice. Businesscards

SunPharma52-weeklow. Promotionalvideos

SunPharmatradingtrends. EventflyersResumes

SunPharmafinancialnews. Processdiagrams

Comment